Financial Risk Management Software

What is Financial Risk Management Software?

Banking Risk Management systems that allow financial institutions to manage all aspects of financial risk while delivering service to their customers.

Common Features

- Analytics and Reporting

- Cheque Management

- Credit Risk Management

- Market Risk Management

- Fraud Management

- Stress Tests

- Transaction Monitoring

- Asset Liability Management

- Anti Money Laundering

- Regulatory Compliance and Audit

- Policy Management

Our Methodology

Composite Score

Vendors are ranked by the composite score, which is comprised of feature, capability, relationship, and overall satisfaction scores while factoring in the volume and recency of reviews.

CX Score

The CX score is comprised of the emotional footprint metrics, balanced by metrics related to the overall value of the software, while factoring in the volume and recency of reviews.

Data Quadrant

SoftwareReviews collects user insights that help organizations more effectively choose software that meets their needs, measure business value, and improve selection.

Rankings, results, and positioning on SoftwareReviews reports are based entirely on end-user feedback solicited from a proprietary online survey engine.

Leaders

Products that resonate strongest in the market, balancing features with a great user experience.

Product Innovators

Products that emphasize product features, gaining strong recommendations from their customers.

Service Stars

Products that emphasize a good user experience and build strong relationships with customers.

Challengers

Products that are strong performers in some areas and trail in others. Often up-and-coming vendors.

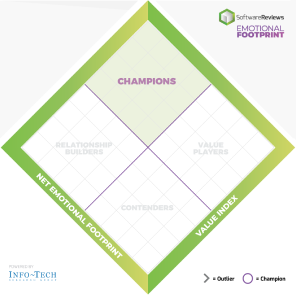

Emotional Footprint

SoftwareReviews collects user insights that help organizations more effectively choose software that meets their needs, measure business value, and improve selection.

Rankings, results, and positioning on SoftwareReviews reports are based entirely on end-user feedback solicited by a proprietary online survey engine.

Champions

Products that resonate highly with users at an emotional level. Users have specific emotional views towards these products like love, trust, and effectiveness.

Relationship Builders

Products that are bulletproof and focus on fulfilling core needs with steady support, not the latest feature.

Value Players

Products that succeed on cost and service effectiveness with users.

Contenders

Products seen as good in some areas and trailing in others. Users look to these for innovation at the edge but aren't fully committed.

Top Financial Risk Management Software

2023 Data Quadrant Awards

2020 Emotional Footprint Awards

At SoftwareReviews, we take pride in recognizing excellence. Each year, we present the Data Quadrant Awards to top-performing software products based solely on authentic user reviews, without any paid placements or analyst opinions. These awards highlight software products that excel in terms of features, vendor capabilities, and customer relationships, earning them the highest overall rankings.

At SoftwareReviews, we take pride in recognizing excellence. Each year, we present the Emotional Footprint Awards to top-performing software products based solely on authentic user reviews, without any paid placements or analyst opinions. These awards shine a spotlight on software vendors who excel in crafting and nurturing strong customer relationships.

Get Instant Access<br>to this Report

Get Instant Access

to this Report

Unlock your first report with just a business email. Register to access our entire library.

© 2024 SoftwareReviews.com. All rights reserved.